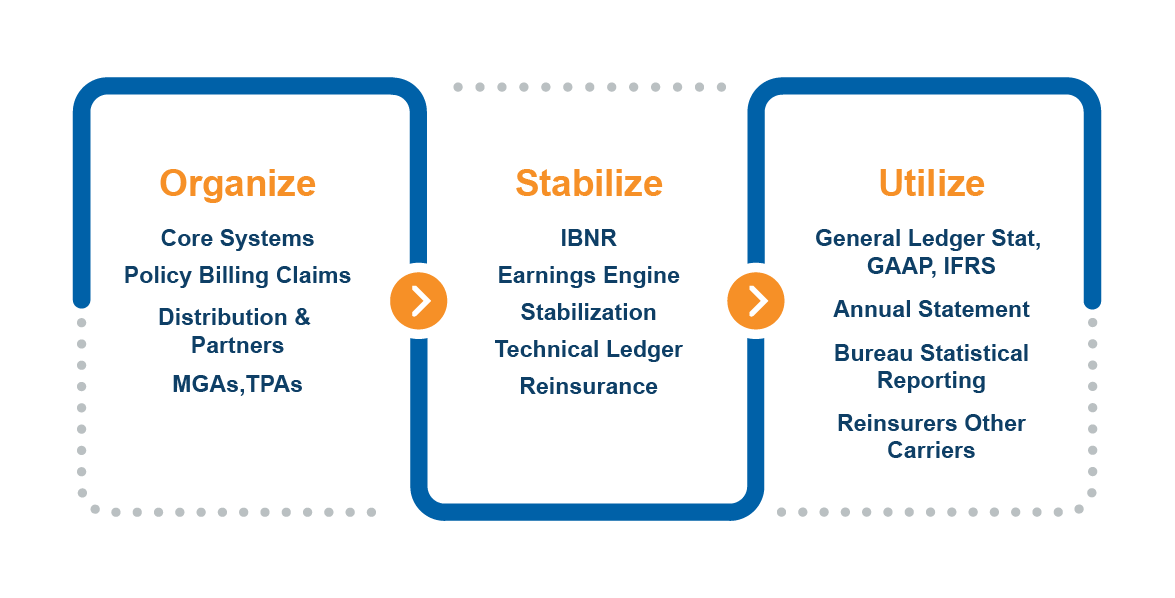

Organize • Stabilize • Utilize

Empowering the Future of Insurance

Data is a pivotal asset for success in insurance. It is not only a competitive booster engine but also the asset enabling vital functions. Most insurers, however, are still chasing the burden of data, instead of taking advantage of what data can do.

How do you go from building data solutions aimed at solving one-off issues to using one data solution to stabilize, streamline and operationalize all data? When it comes to data transparency we’ve always said ‘Daylight is a great disinfectant’ so we have created Insurance Daylight Data Solution (IDDS) as a turnkey solution for insurance organizations to fully optimize their data.

Data stabilization — one version of the truth

Data within core systems isn’t stable. It doesn’t always relate back to an accounting period. It causes operational systems and financial systems to work independently. Data stabilization allows companies to tie operational and financial systems together, allowing anyone to use the data with confidence. IDDS gives companies one version of the truth that everyone can agree upon.

Vision needs daylight.

Businesses need clarity to achieve their visions and enable operations. They need to control their data in ways that it will provide a crystal clear view. IDDS brings daylight to data. It allows insurers to switch their focus from data management to business clarity — a change that naturally produces insight-fueled results.

Become a Data Driven Company

Wikifri’s Insurance Daylight Data Solution (IDDS) enables your company to be data-driven, while at the same time helping to meet all of your insurance functional data obligations. It consolidates and stabilizes data from multiple core systems and distribution partners (including bordereaux data) to create a single-version-of-the-truth. IDDS matches operational data from core systems and other distribution partners to financial systems, including stabilizing accurate accounting periods.

Through IDDS, insurers gain access to a secure, multi-tenant cloud environment that provides an environment for analytic uses and runs the entire back office of a carrier, MGA or other insurance organization.

IDDS is ideal for:

What can IDDS do for you?

Enables

Product Development

Streamlined Processes

Financial Reporting / Analysis

Integration of Acquisitions

Advanced Analytics

Exposure Modeling

Artificial Intelligence

Management Reporting

Retirement of Legacy Systems / Data Stores

Operations

Stabilizes data in technical ledger

Performs earnings calculations

Performs IBNR Calculations

Light Reinsurance Processing

Financial close Processing

Analytics and Reporting

Insurance Functions

General Ledger reporting to Stat

Uses GAAP, IFRS Standards

Annual Statement Prep

Bureau Statistical Reporting

Reinsurance Reporting

Bordereux to other Carriers

Bordereaux to Reinsurers

IDDS Use Cases

“Data is our important asset, and we have to harness its potential in order to transform for the future. We need functions such as understanding the performance of our portfolio of risk, the production of our teams and distribution partners and if our pricing is working to fuel our P&L. Data allows us to be transparent with our partners, helping to form more valuable relationships”

“Data powers underwriting. Having stabilized data enables our organization to accurately price risk and understand the production of our distribution partners. It enables accurate exposure modeling and other advanced analytics, so we can leverage ALL of our available underwriting platforms for capitalizing insurance.”

“To create a technology-enabled operating model, we need to centralize and stabilize the data from all of our core systems including the legacy and the new systems. Having centralized data will allow us to achieve operational excellence, understanding how our business performs and putting data in the hands of all of our functional teams, empowering them to do their jobs and informing them to make the right decisions.”

“We need a ‘single version of the truth’ to produce financials and regulatory reporting. Our current system environment makes that a complicated challenge to solve with multiple, disparate processing systems and data that has accumulated over the years. ”

“Our business stakeholders are not using the data environment we created. The ‘if you build it, they will come’ has not come to fruition. We are burdened by legacy tech debt that is expensive to maintain and doesn’t serve the needs of the underwriting, finance and operations stakeholders.”

Insurance Daylight Data Solution Successes

“We have a long history of being a successful MGA and have grown by acquisition. This success has created a complex technology landscape of disparate core systems. Our new strategy involves bringing in new systems and data through launching new programs. IDDS is essential to this strategy. It provides a single-source-of-truth of our data. We can sunset legacy platforms and now have a playbook for on-boarding new programs, while satisfying the data needs of our carrier partners.”

— Steve Sitterly, Chief Operating Officer

“As a startup insurance company, we had the benefit of creating a modern insurance architecture and believed that the essential components included core systems, general ledger and a data solution. Wikifri gave us a cloud-based solution with IDDS. Not only does it perform essential insurance functions for our back office, but it feeds our general ledger and provides essential regulatory reporting data for WCPols and Unit Stat to regulatory agencies.”

— Ciro DeFalco, Managing Director & Chief Financial Officer

Find out how IDDS can transform your data into an asset for growth and operations.

Contact us today.