By Nick Coenen & Dan Mets

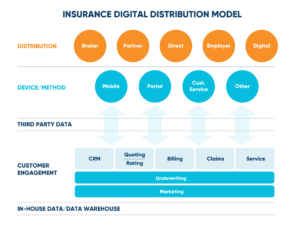

When organizations begin to envision their company’s new digital capabilities, they need to think about the high-level areas that are ripe for digital transformation: portal, mobile and platform integration. They need to consider how each new digital opportunity will be impacted by both customer and distributor facing systems as well as the internal systems and processes that enable customer engagement. (See Fig. 1)

Fig. 1 Digital distribution requires far more than portal development. It requires a holistic look at both how interactions/transactions take place and an assessment of which back-end systems and processes will be impacted.

Portal

It’s easiest to begin with the customer and agent portal, because this is the area of broadest functionality.

Customer Service is the report card of insurance processes. Today’s digital portal needs to allow customers and/or agents to quote and bind business online. Online customers will abandon a transaction if it requires too much effort. Digital service brings speed and efficiency to the process to keep those prospects. For example, a portal with a well-integrated third-party network can auto-fill much of the form data. This will reduce data entry.

Agent-based distribution may require more data and a greater understanding of the products, but efficiency is no less important. Insurers need to define what capabilities they want to provide and create a process that is simple to follow. Every transaction deserves scrutiny, even basic servicing transactions like name and address changes.

Of course, the portal is also a natural location to place upsell and cross sell messages for either agents or customers. Increasing marketing opportunities will naturally improve the ROI for digital redesign.

Mobile

Nearly anything that a portal can do, mobile can do…portably. The only major difference is that phone size is a constraint and mobile users are less patient than desktop users because they are often in the middle of something else. When designing a mobile experience, it is imperative that the experience between mobile, telephone and desktop appear to be seamless. Can the customer service representative access the same transaction that the mobile user is attempting to establish? Can the agent see what the prospect is looking at? Complete synchronization will require core data and communication layers to be digitally optimized and transaction tracking to be in place.

Third-Party Platform Integration

For any insurer hoping to reap the harvest of a digital future, 3rd party integrations are a two-way pipeline to growth. First, the insurers need to effectively incorporate 3rd party data. This is a “given.” The number of potential efficiencies and automations will just continue to grow as data becomes more available and relevant.

The other 3rd party integration involves platforms. As the gig economy grows, more and more employees work for a platform company. The ability to design products for this market and the ability to easily integrate with the platforms provide market opportunities. Micro services architectures can provide these opportunities and allow for quick and easy integration to 3rd party platforms. This one step, micro services readiness throughout the enterprise, will go a long way toward minimizing disruption to insurer processes.

Why Efficiency is Exciting

The insurer that is pro-active in analysis, taking full advantage of digital’s opportunities for efficiency has two more reasons to celebrate digital project success.

Experience

What does an efficient transformation process do for the future organization? Insurers with the wisdom to holistically navigate one disruption are far more prepared for the next one. Organizations that are “in touch” with their current processes and that understand their desired future state processes are in an excellent position to make the most of transformations. They can see clearly to the first destination. They learn how to transform on the fly, and they gain the confidence and know-how needed to do it again.

Value

The wisdom gained by solving digital dilemmas allows a company to start flexing its muscles into driving transformational value. Digital experience allows insurance executives to get creative. The organization can then begin to ask the deeper questions, not just about how to drive efficiencies, speed processes and serve the customer, but also how to best utilize resources, capture and use relevant customer data and make the solution “pay its way.”

Positioned for the Future

Distribution is always expanding. This makes digital distribution a tool for growth and a reusable resource. The manner in which digital distribution is constructed within the organization will in many ways dictate how prepared the organization is for future growth.

It may be that a larger transformation must be undertaken that will include a more complete set of future-focused solutions. These will keep the company flexible and in-tune with market demand. Either way, the first step is to know and understand the Insurance Business-Oriented Operating Model and how it works within the organization.

Once this happens, nimble insurers with modern architected systems will be ready to capture market opportunities in an increasingly technology-driven marketplace.

Technology driven markets can pop up and grow very rapidly. The COVID period has seen many platforms experience unbelievable growth in a very short period of time. As consumers quickly adopt new technologies and new ways to buy products, insurers need to keep pace and sell products the way consumers want to buy them. Wikifri is an expert guide through the hurdles of digital distribution. If you are in the midst of digital transformation or you are considering how to holistically take advantage of all that digital has to offer, e-mail us today at info@wikifri.com.